An Ultimate Guide On How To Write A Good Financial Statement Analysis In Several Steps

Mike Russel

Are you studying finances or doing an MBA course? You will definitely need to write a financial analysis paper someday. Such reports offer details about companys’ financial health. They help investors and financial analysts check whether a business can deliver a solid return on investment. Moreover, students often seek finance assignment help to better understand how to create these reports and improve their understanding of the subject.

But how to write a financial analysis paper and make it reliable and comprehensive? What should be taken into consideration, and how to format your report properly?

This article will present some tips that will help you create a good financial statement analysis report.

Main Features Of A Financial Analysis Paper

So, what is a financial analysis paper, and why does it require lots of time and effort? Such reports are also known as financial statement analysis, and they are a type of papers that evaluate company’s, project’s or business’:

- stability

- profitability

- viability

Their main aim is to analyze companys’ financial components and suggest how to improve the indicators in the future. They are also valuable for investors and financial analysts.

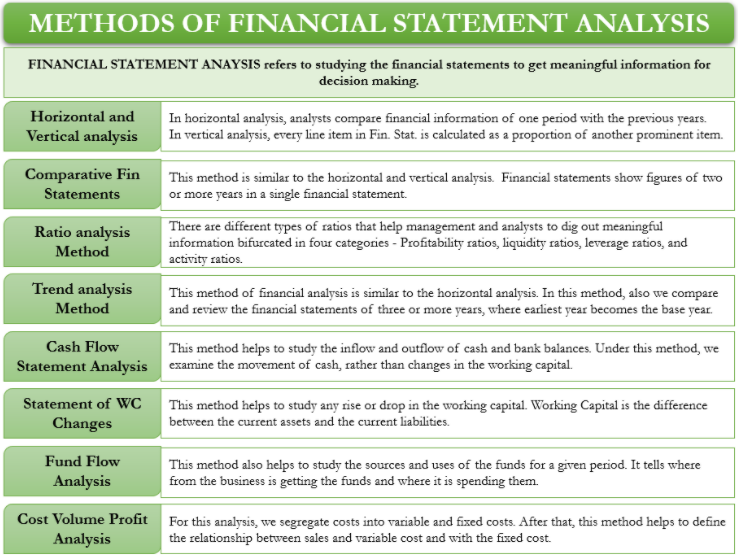

There are various financial analysis techniques and methods that should be used while preparing a report.

Moreover, this paper has a special format and should contain such sections as:

- cover page

- content page

- executive summary

- informational sections

- summary

- appendix

So, writing a financial statement analysis report is quite a challenging task. However, the tips and recommendations provided below will help you create a good financial statement paper.

A Guide On How To Create A Good Financial Analysis

Here are some tips and recommendations that will let you write a comprehensive financial statement paper in several steps:

- Check The Requirements And Set Your Goals

Start with checking the requirements provided by your instructor. Ensure that you understand all the guidelines. Set your goals and think of a business overview that will help you explain whether a company is worth investors’ attention.

- Read Various Examples Of Financial Analysis Papers

There are plenty of financial statement analysis paper examples available online. Read several samples to get acquainted with the structure of such reports. Write down the main points and create an outline of your future paper.

- Create An Outline Of Your Paper

There are various reasons for creating an outline:

it helps you come up with ideas

it organizes the ideas

it lets you present the material in a logical form

Generally speaking, a thorough plan will help you structure the report and properly organize your work. - Check Company’s Financial Health

Carefully check a company’s financial performance. Pay attention to financial statements, ratios, and competitiveness. Get acquainted with a company’s annual report with exchange commissions and securities.

Write a thorough description of a business explaining whether it is a good option for investment.

Create a list of the advantages and disadvantages of a company and mention its core:

competencies

capabilities

tangible and intangible assets

competitive advantages - Follow The Structure

As soon as you’ve thoroughly checked a company’s financial performance, start working on your report. It should include such sections as:

business overview and investment thesis

executive summary

financial statement

industry analysis

financial ratios

valuation

Let’s have a closer look at each section and find out what should be mentioned there:

Business Overview And Investment Thesis

Start your report with an overview of a company, its financial health, and its performance. State if it is a good investment option and describe what advantages over its competitors it has.

Include the investment thesis at the top of the report and mention such things as:

the main investment negatives and positives

sales and profit growth trends

cash flow generation strength

company’s debt level

company’s liquidity and reliability

Executive Summary

This is an important section as the majority of end-users mainly pay attention only to an executive summary. It usually includes:

a company’s overview, history, and summary of its missions

current performance and expected outlook

a company’s competitiveness

market conditions

This part of the report should be prepared in an easy-to-read format and contain all the relevant data presented throughout the paper.

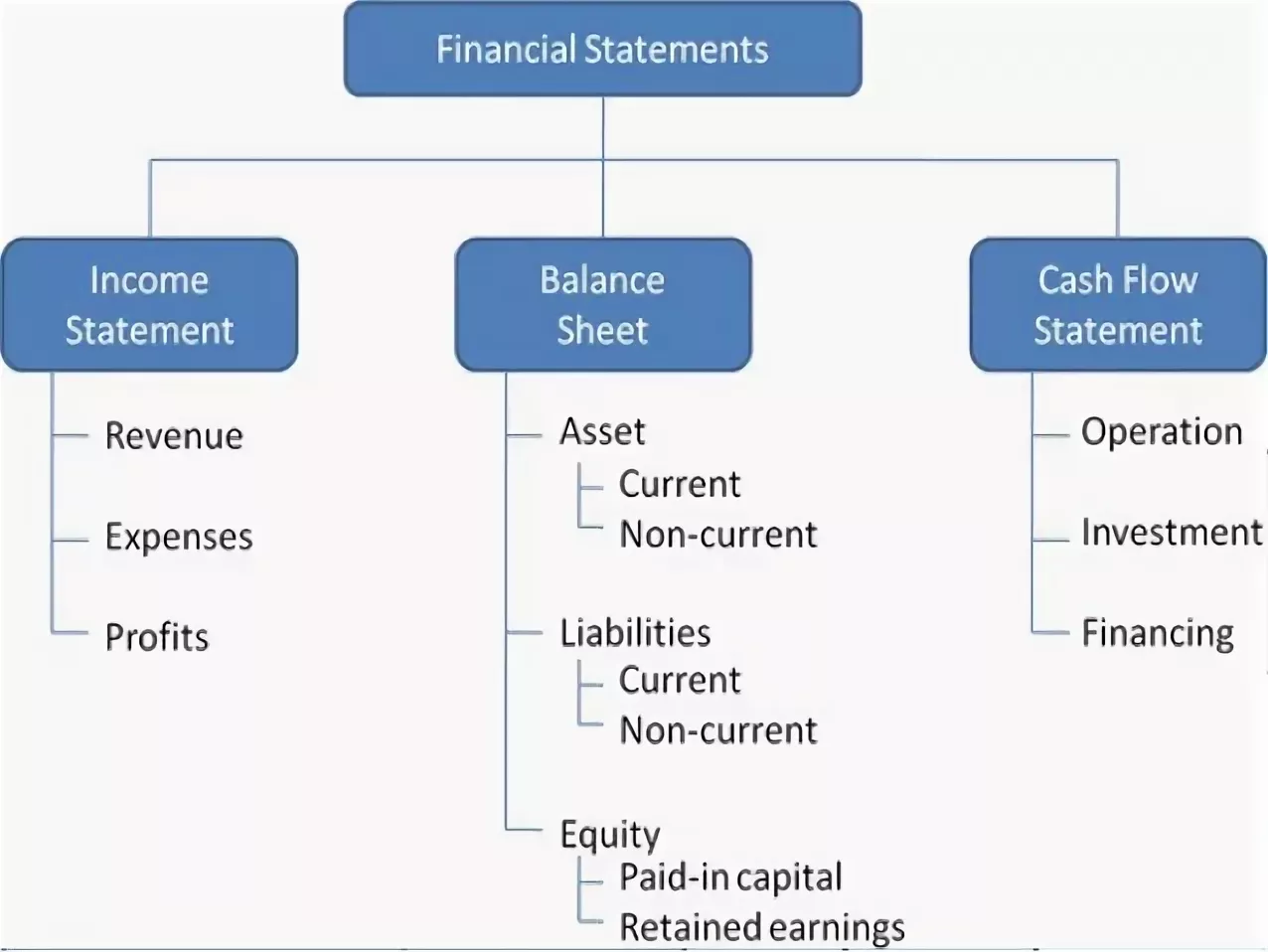

Financial Statement

Ensure that your report contains the collection of a company’s financial statements and includes:

balance sheet

equity statement

income statement

business cash flow statement

Industry Analysis

Obviously, it is vital to evaluate the industry a company is operating in. The main idea of this section is to present the comparison between the business and the competitors. Investors want to check a company’s market share and whether it is prominent in the industry of operation. It lets them realize if a business is competitive enough and could make a lucrative investment.

Financial Ratios

This part of the report provides a company’s liquidity, debt, and efficiency. The ratio consists of:

current liquidity ratio that examines an ability of a company to pay obligations either short-term or within a year

debt ratio that examines the amount of a company’s leverage in terms of totals debts and assets

price to income ratio that shows a company’s stock price compared to its earnings per share. This ratio helps evaluate whether a business is a good option for investment

Valuation

It is one of the most significant parts of the report that suggests an independent value for the stock compared to the current market price. There are three main techniques that help get and provide relevant information:

discount cash flow analysis

relative value

book value

The first technique estimates investment value that is based on a company’s future cash flow. The second one helps determine an asset’s worth by comparing the value of similar assets. And book value lets estimate an approximate business worth in case of collapses and liquidates. - Edit And Proofread The Final Version Of Your Analysis

Leave some time for checking your paper as financial analysis reports require special attention:

Ensure that all the data is accurate and relevant

Pay attention to formatting and check that your report contains all the required sections

Verify that your paper doesn’t have any logical, grammar, or punctuation mistakes

Conclusion

To conclude, a financial statement analysis report is a paper that should be prepared in advance. It requires a thorough examination of a company. It should provide a comprehensive evaluation of its financial performance.

Those who write such reports need to pay attention to details. It is essential to suggest an extensive business review that will let investors decide if a company is worth attention.

Do you feel confused and don’t know how to properly organize your report? Are you tired and can’t complete all the assignments on time? Luckily, there is an option for you! Ask for professional help from the best finance essay writing service and get your report rapidly.

Some reliable writing companies are glad to prepare such papers for reasonable prices. They don’t only offer paper help but also suggest useful articles for those who study finances. Their top writers will create a report following your instructions and will answer your questions related to the topic.

Mike Russel

Latest Stories

Here’s what we've been up to recently.